child tax credit september delay

The Internal Revenue Service IRS sent out relief payments on September 15 worth up to 300 per child but more than 200 parents have complained they. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the Covid relief money last week.

. This third batch of advance monthly payments totaling about 15 billion is reaching about 35 million families today across the. Instead 2 percent of these eligible households discovered that their payments had gone missing. Checks were supposed to be sent out on September 15 and millions of Americans were due to receive the cash days later.

Parents eagerly expecting their third enhanced Child Tax Credit payment last week say they experienced a delay in getting the money as. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

Including the last half of the tax credit recipients could get a total of up to 3600 per child 5 years old and younger and 3000 for every child between 6 to 17 years old. September 28 2021 1027 AM MoneyWatch. How much are the child tax credits.

The IRS on Friday release declared that due to a technical issue the payments for the last month got delayed for a small number of advance child tax credit recipients in September has now been sorted while explaining about the fourth monthly payments of the program. October 16 2021 by Rahis Saifi. Given how heavily some families are relying on their Child Tax Credit payments the fact that Septembers installment has been delayed for many recipients isnt a.

Families that meet the requirements will receive 300 per month for each child under 6 years of age and 250 for each older child. The Internal Revenue Service failed to send child tax credit payments on time to 700000 households this. Eligible families will receive up to 3600 for each child under the age of 6 and a maximum.

The Child Tax Credit has been expanded from 2000 per child annually up to as much as 3600 per child. However many families are still waiting for the payment that was due on September 15. Many families could be looking at an extra 450 a month or more depending on the size of the family and the ages of the children.

15 and while most households have received their payments not all households have been so lucky. The last Child Tax Credit check was issued on Sept. The IRS acknowledged a few weeks ago that there were technical problems that caused delays in the September child tax credit payments.

601 ET Sep 29 2021. The credit is 3600 per year for children under 6 years of age and 3000 for children 6 to 17 years old. Last September 15 families that got payments in July and August should have received their third CTC payment.

September 22 2021 750 PM CBS Pittsburgh PITTSBURGH KDKA -- Some families who were expecting a child tax credit payment a week ago still have not received it. SOME cash-strapped families were left waiting for their 300 stimulus check after a technical issue caused Septembers child tax credit payments to be delayed. HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the Covid relief money last week.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. Payments began in July and will continue through December with the remaining. Families with incomes of up to 200000 for individuals and 400000 for married.

After the July and August payments the first two in the special 2021 child tax credit payment schedule were. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. September 17 2021.

September 27 2021 744 AM.

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Cost Of Living Payment Dwp Warns 326 Due In July May Be Delayed Nationalworld

Child Tax Credit 2022 Update Americans Can Get Direct Payments Up To 750 But Deadline To Apply Is Just Weeks Away The Us Sun

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

The 2021 Tax Filing Season Has Begun Here S What You Need To Know Cnn Business

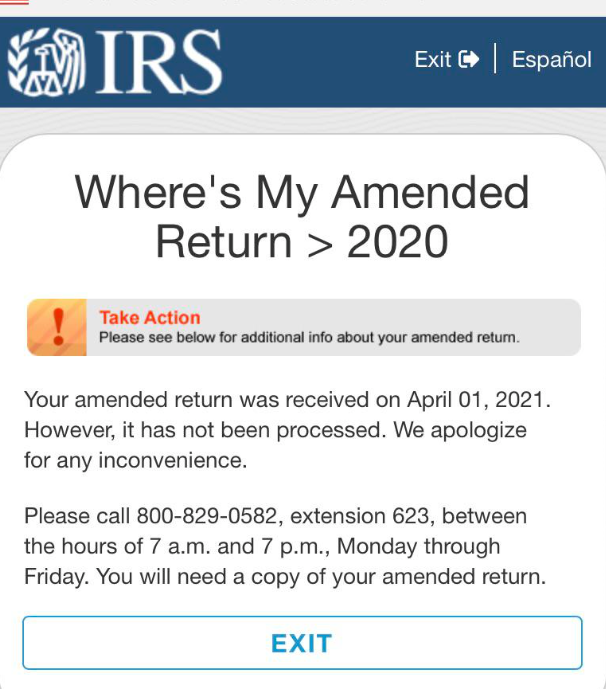

Where Is My Amended Tax Return And When Will I Get My Refund Checking 2022 Payment Status And Direct Deposit Aving To Invest

Child Tax Credit 2022 Update Americans Can Get Direct Payments Up To 750 But Deadline To Apply Is Just Weeks Away The Us Sun

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

Irs Stuck In Backlog Of Tax Returns Scraps Plan To Close Austin Processing Facility The Washington Post

![]()

September Child Tax Credit Still Not Issued R Stimuluscheck

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2022 750 Direct Payments Being Sent To Thousands In Just Weeks Find Out Exact Date The Us Sun

How Can I Claim My Remaining Child Tax Credit Ctc Or Missing Dependent Stimulus Payment In 2022 Irs Refund Payment Delays

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)